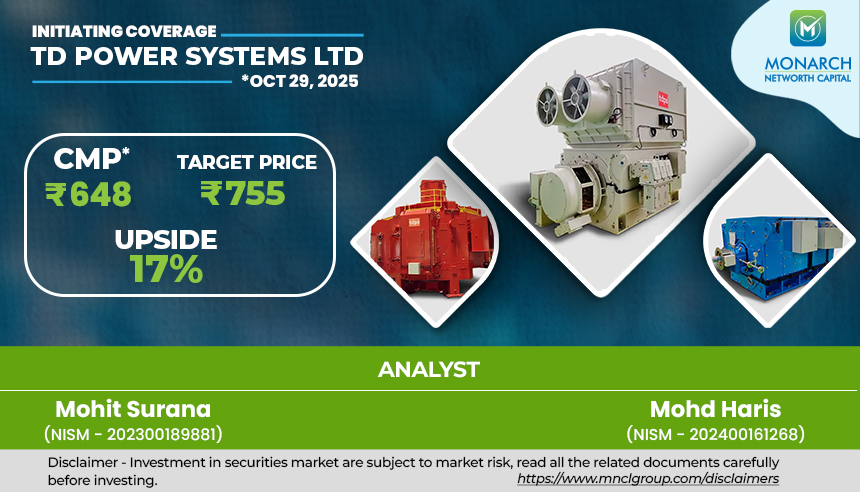

We initiate coverage on TD Power (TDPS) with a Buy rating and TP of Rs 755. India’s mid-sized industrial equipment space is witnessing a renaissance driven by structural trends in decentralized power generation, industrial energy efficiency, and the global shift to renewables and storage-backed systems. Within this landscape, TDPS stands out as a high-quality play in the power conversion value chain with a strong presence in AC generators. The company boasts deep engineering capabilities, robust balance sheet, and delivers best-in-class returns, positioning it as a beneficiary of the energy transition related capex upcycle and AI boom over the next 3–5 years. We expect an attractive revenue and PAT growth of 22-23% for TDPS over FY25-28E.

TDPS is a leading manufacturer of alternating current (AC) generators of less than 60 MW capacity range on an average supplying to OEM turbine makers and EPC contractors globally. The company plays a critical role at the electrical end of the power generation value chain—converting mechanical energy into electrical output—making it integral to multiple generation technologies. The business benefits from strong industry tailwinds such as the expansion of distributed and decentralized power systems, the rise of renewable and waste-to-energy (WtE) projects, growth in industrial captive generation, and the accelerating demand for backup and prime power from data centers and AI-driven digital infrastructure.

Exports have become the key growth engine for TDPS. The company derives ~70% of order inflows from exports and deemed exports, with presence across 110 countries. The company’s global OEM partnerships (including leading turbine makers) enable steady repeat business. Sectoral exposure is well-diversified across renewables (biomass, waste-to-energy), industrial CHP, process industries (sugar, cement, chemicals), and data centers. This diversification across geographies and sectors reduces earnings volatility and enhances visibility of long-term growth.

The company is investing to align with the next wave of decarbonization and grid transformation. TDPS is expanding into customized generator-motor systems for industrial and renewable applications, backed by a new 0.22 mn sq ft Bengaluru facility (Rs1.2 bn capex) expected to be commissioned by Q3-FY26. The company is thus positioned to benefit from the evolving energy transition and storage ecosystem in India and overseas.

TDPS merits premium valuation within the Indian capital goods universe given its strong positioning in the AC generator segment, global competitiveness with low-cost engineering edge, consistent >20% return ratios and robust balance sheet. We value the stock at 40.0x September 2027E EPS and arrive at a Target Price of Rs 755 for TDPS, implied upside 17%. Our bull case valuation indicates an upside of 34%.

Further worsening of cash conversion, and slowdown in global industrial capex in the energy sector.

Company website: https://www.tdps.co.in/

Rating: BUY

CMP: INR 648

Target Price: INR 755

Upside: 17%

Click to download the full TD Power IC Report

Disclaimer: - You are advised to read our disclaimer here: https://www.mnclgroup.com/disclaimers

Empower your finances with ReSach – the stock trading apptrusted by serious investors. Whether you're planning to invest in stocks, explore commodity trading, or need a financial advisor to guide you, Resach brings it all under one platform.

Start trading today with ReSach and unlock seamless investing on the go.

Name of the Company has changed from Networth Stock Broking Limited to Monarch Networth Capital Limited upon Certification of Incorporation received from Registrar of Companies, Mumbai vide certificate dated 13th October, 2015.

If you are not satisfied with the resolution provided, you can lodge your complaint online at: https://scores.sebi.gov.in/link

In case of grievance client can log on to the SMART ODR Portal, if they are unsatisfied with the response provided by us. Your attention is drawn to the SEBI circular no. SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/131 dated July 31, 2023, on “Online Resolution of Disputes in the Indian Securities Market”.

Purchase of REs only gives buyer the right to participate in the ongoing Rights Issue of the concerned company by making an application with requisite application money or renounce the REs before the issue closes. REs which are neither subscribed by making an application with requisite application money nor renounced, on or before the Issue closing date shall lapse and shall be extinguished after the Issue closing date. Please check your dp account for further details.

Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses.

Monarch Networth Capital Limited (‘MNCL’) | CIN No.: L64990GJ1993PLC120014

Unit No. 803-804A, 8th Floor, X-Change Plaza, Block No. 53, Zone 5, Road-5E, Gift City, Gandhinagar - 382050, Gujarat

Ahmedabad

“Monarch House”, Opp Prahladbhai Patel garden, Near Ishwar Bhuvan, Commerce Six Roads, Navrangpura, Ahmedabad - 380009

Mumbai

Monarch Networth Capital Limited, G Block, Laxmi Tower, B Wing, 4th Floor, Bandra Kurla Complex, Bandra East, Mumbai - 400051.

Email for Grievance: grievances@mnclgroup.com

Investors are requested to note that Stock broker (Monarch Networth Capital Ltd) is permitted to receive money from investors through designated bank accounts only named as Up streaming Client Nodal Bank Account (USCNBA). Stock broker (Monarch Networth Capital Ltd) is also required to disclose these USCNB accounts to Stock Exchange. Hence, you are requested to use following USCNB accounts only (Click to View) for the purpose of dealings in your trading account with us. The details of these USCNB accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker".

Mechanism for addressing grievances and information about SCORES.

Monarch Networth Capital IFSC Private Limited (Wholly owned subsidiary of Monarch Networth Capital Limited) is a Registered Fund Management Entity (Retail) having Registration No: IFSCA/FME/III/2025-26/169. Monarch India Growth Fund will be an open-ended Restricted Scheme (Non-Retail) construed as a Category III AIF under the IFSCA (Fund Management) Regulations, 2025. Monarch AIF is a Category III AIF having SEBI Registration No. IN/AIF3/20-21/0787. This material is for informational purposes only and is not intended as an offer or solicitation or investment advice to buy or sell securities. Investments are subject to market risks. The offering is made only through official scheme documents to eligible investors under GIFT IFSC regulations. Investors should read all documents carefully and consult their advisors before investing.

Mechanism for addressing grievances and information about SCORES.

Monarch Networth Capital Limited (‘MNCL’) | CIN No.: L64990GJ1993PLC120014

(As per LODR Regulations and Companies Act, 2013)

Contact information of the designated officials of the listed entity who are responsible for assisting and handling investor grievances : Mr. Nitesh Tanwar

Monarch Networth Capital Limited

Unit No. 803-804A, 8th Floor, X-Change Plaza, Block No. 53, Zone 5, Road-5E, Gift City, Gandhinagar - 382050, Gujarat

Ahmedabad

“Monarch House”, Opp Prahladbhai Patel garden, Near Ishwar Bhuvan, Commerce Six Roads, Navrangpura, Ahmedabad – 380009

Mumbai

Monarch Networth Capital Limited, G Block, Laxmi Tower, B Wing, 4th Floor, Bandra Kurla Complex, Bandra East, Mumbai - 400051.

Phone: 022 - 66476400 / 66476405

Email: cs@mnclgroup.com

Email for Grievance: cs@mnclgroup.com

Listing of Equity Shares on Stock Exchange at

BSE

NSE

(Formerly known as Link Intime India Private Limited)

For any queries related to broking please contact helpdesk@mnclgroup.com.

‘Investments in securities market are subject to market risks, read all the related documents carefully before investing.’